Change is the only constant in this technological era

Today, technology is seeping into almost all areas of our lives, be it education, healthcare, nutrition, banking or entertainment. This has happened to an extent that children are being exposed to technology during their formative years. While gaming and education are two popular areas that kids use technology for, certain areas are yet to gain that momentum.

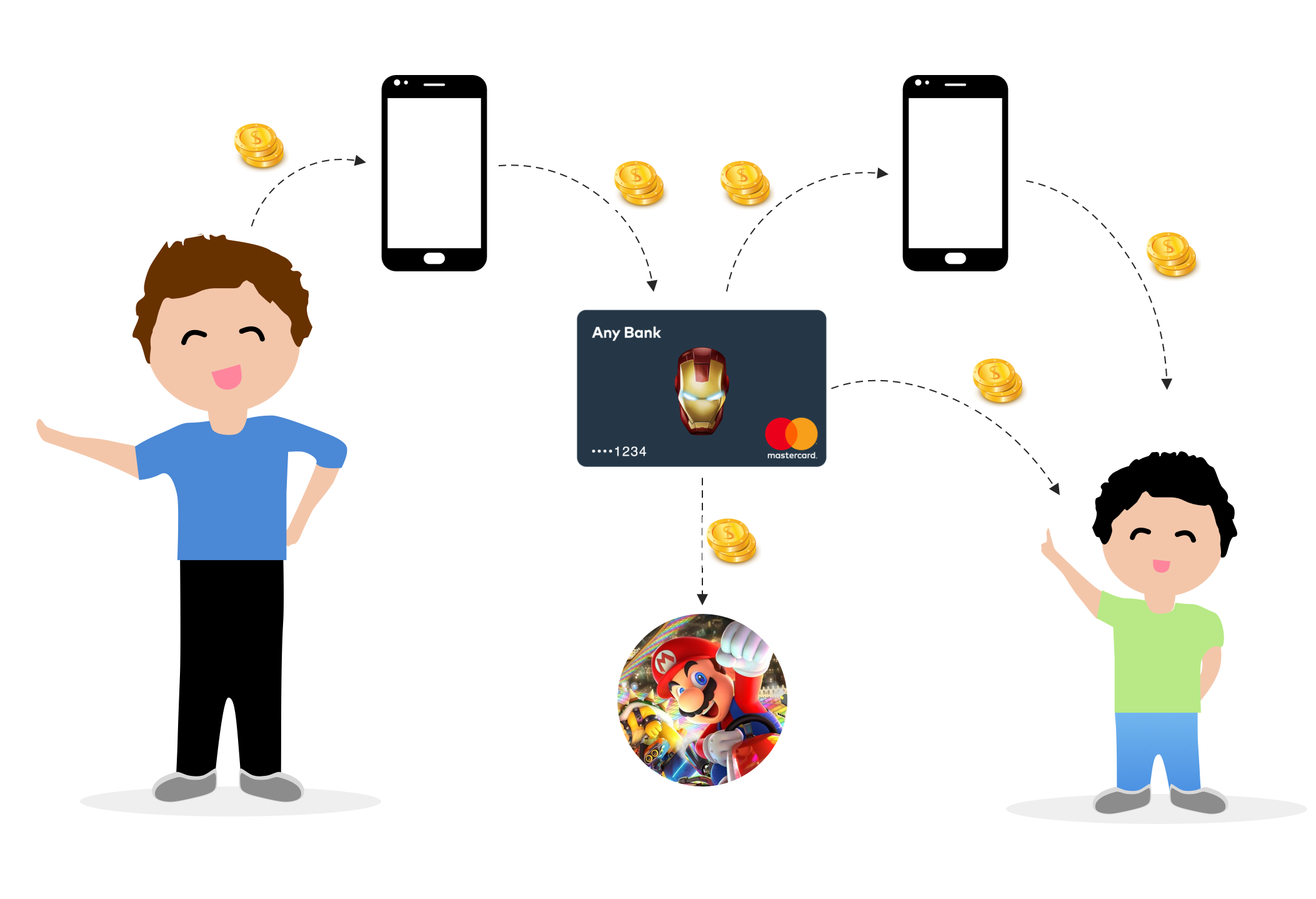

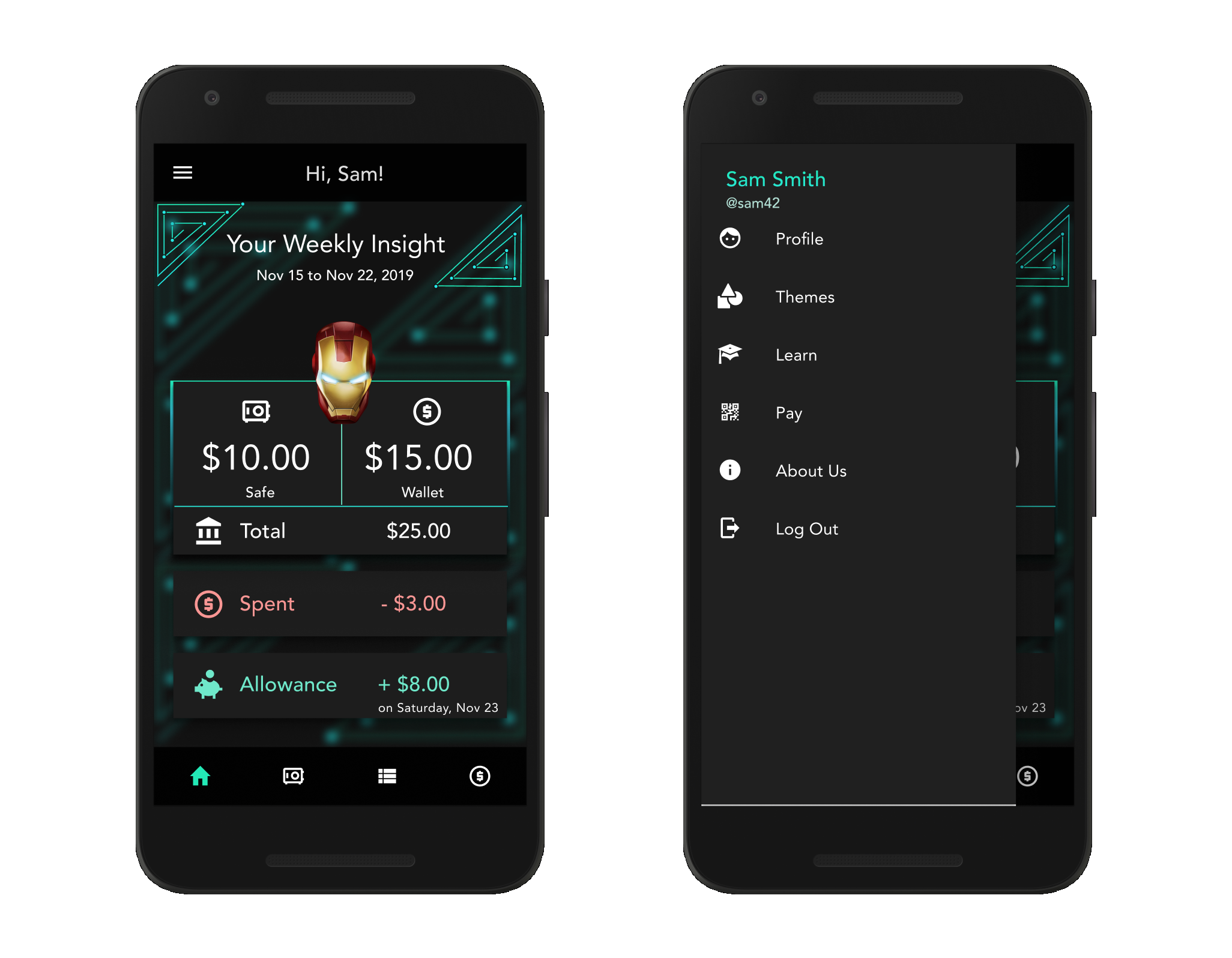

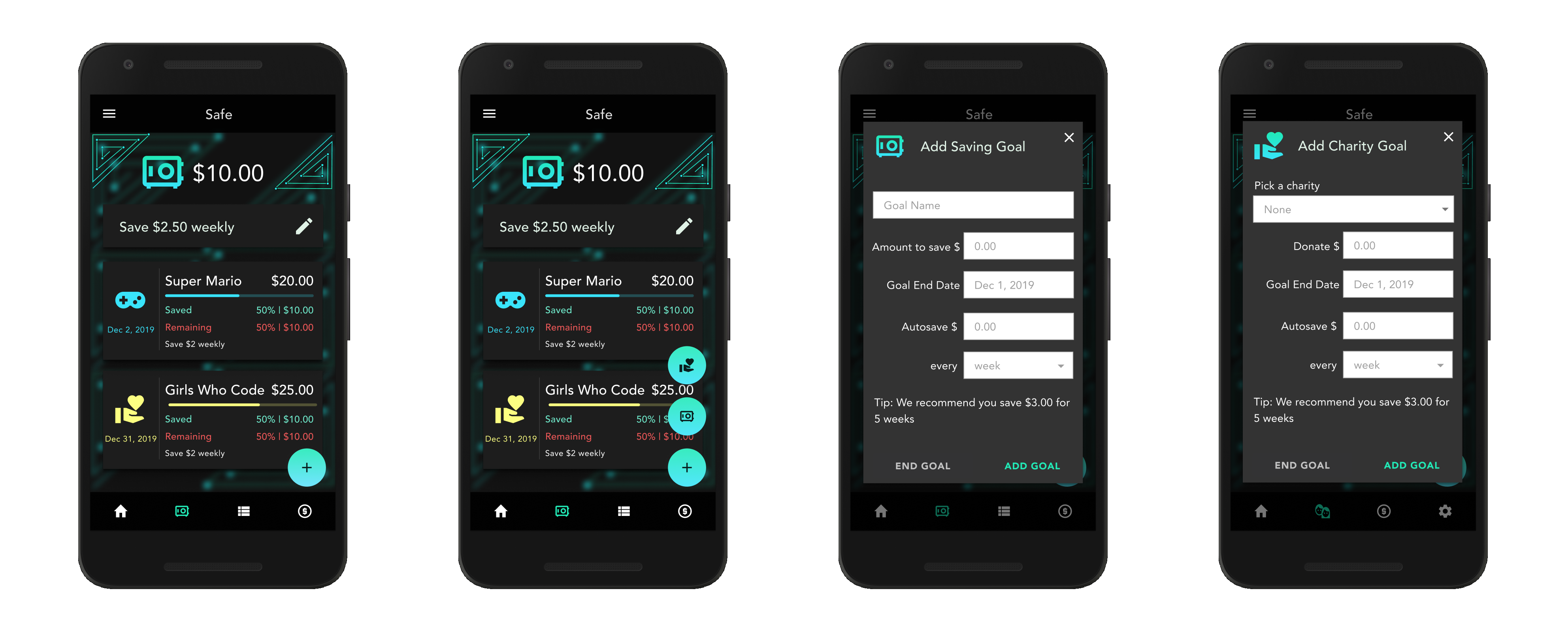

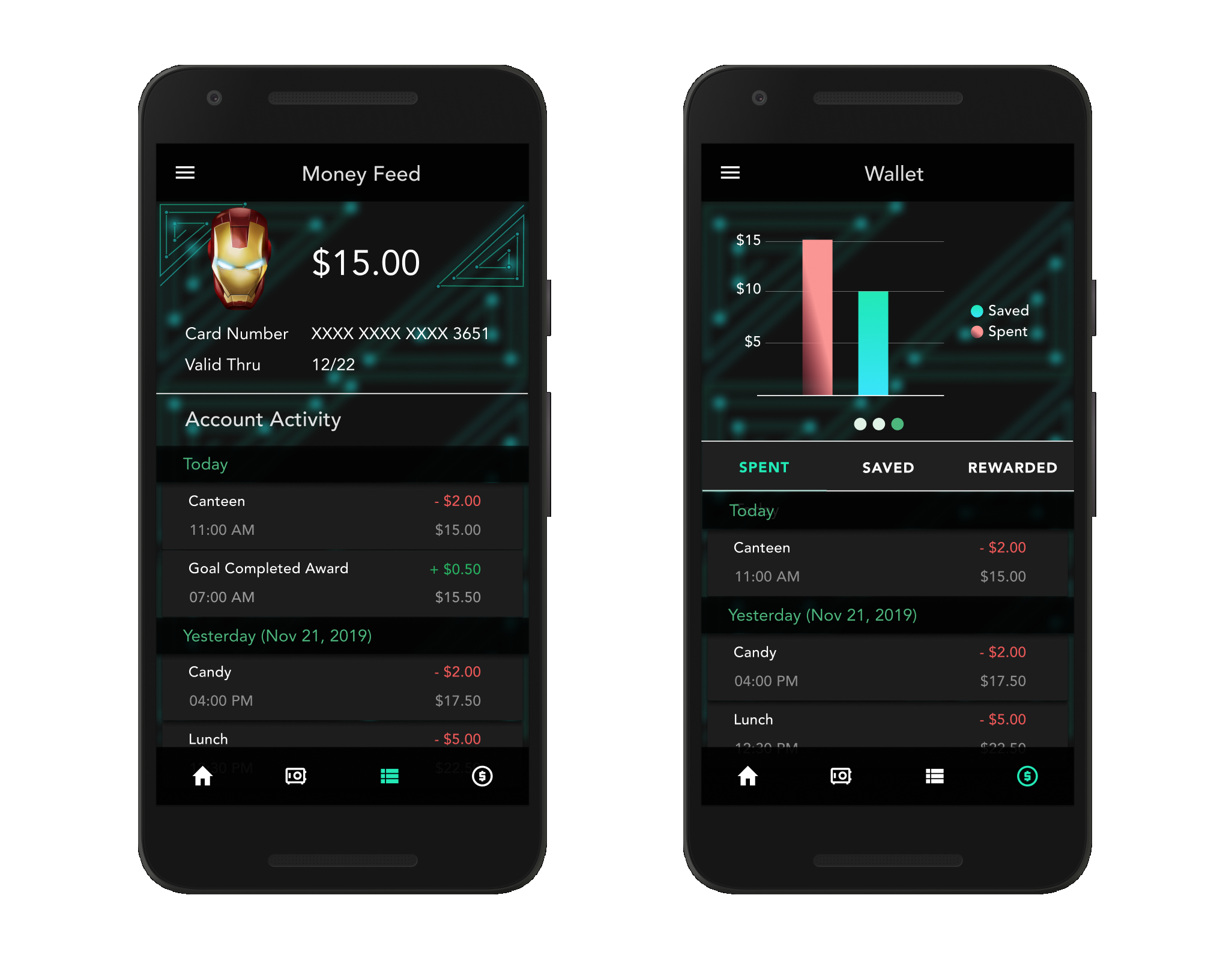

In tech-savvy households, children are being taught how to handle their allowance money with the help of apps. While this has gained considerable popularity in the UK, that hasn't been the case in the US. As a curious being, I wanted to tinker and see what would it take to design a financial app for kids and nurture important decision making from early years.